Inheritance Tax: Another threat to family wealth

It is being widely reported in media that Jeremy Hunt will announce a further freeze to Inheritance Tax allowances on Thursday 17th November in the upcoming fiscal statement, but what is the potential impact of this decision? In this article we explores this important issue.

The standard Nil Rate Band allowance, which was last increased to £325,000 in 2009, had already been frozen, by then Chancellor Rishi Sunak in his April 2021 Budget Statement, until April 2026. It appears that freeze is now likely to be extended to April 2028. Analysis by accountancy firm RSM suggests that this could result in 10,000 more families paying Inheritance Tax during those two tax years, whilst investment managers Quilter expect Inheritance Tax receipts to increase by £1bn during the same period. Although the impact is likely to be negligible when compared to any changes to Income Tax, National Insurance or VAT, the impact on individual families could be significant.

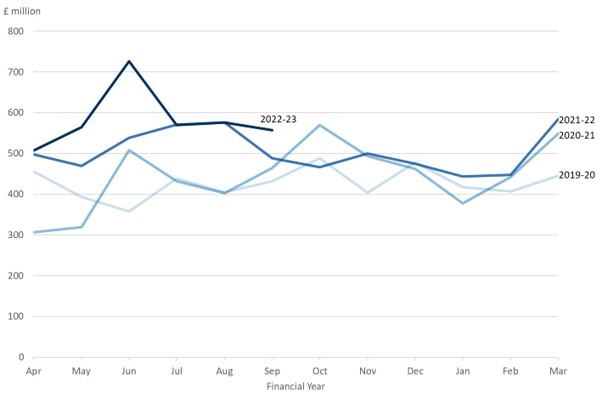

The above announcement will follow figures released by HM Revenue & Customs in October showing that Inheritance Tax receipts had increased by £0.6 billion in September compared to the same month in 2021. The overall take since April has now reached £3.5 billion with Inheritance Tax receipts for this year now expected to far exceed the record £6 billion received in financial year 2021/22.

Source: HM Revenue & Customs

HM Revenue and Customs’ own analysis of the trend identifies that the freezing of the Nil Rate Band allowance coupled with an increase in wealth transfers during the Covid-19 pandemic and a rise in asset values (particularly residential property prices) has resulted in higher receipts.

How can we help you?

Whilst it is clear that the government hopes to continue to increase Inheritance Tax returns by extending the freeze on allowances, Inheritance Tax remains one tax that individuals can take steps to minimise through effective planning. Our team of experienced advisers can assist with this process by providing you with bespoke inheritance tax planning advice for your particular circumstances.

The team can also advise you on the preparation of Wills and any other legal aspect of planning for the future, which can provide you with some peace of mind in this financially turbulent climate.